OUR TEAM

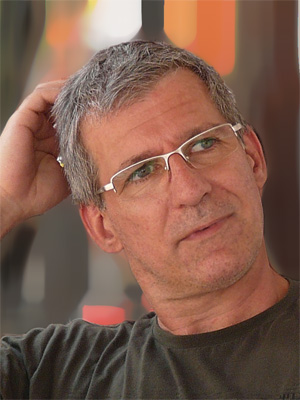

VOLKER DISCHLER, CEO

Volker has 25 years’ experience in the financial industry, and is Head of

Quantitative Research at Invest in Heads – a Private Investment Office specialized on value investing (global equity) and management valuation.

He studied business administration at the University of

Cologne, and wrote his diploma thesis on financial forecasting and

trading systems based on artificial intelligence and led

workshops on neural networks in finance; he also won a New York

scholarship from Deutsche Bank.

Before founding Quant Trading in 2005, he implemented hybrid (ANN,

GA, fuzzy logic) trading systems for Goldman Sachs, launched the division

technical trading systems & managed futures at Portfolio Concept, and

worked in Equity Derivatives Trading at WestLB. He was also responsible

for project management of AI-based investment strategies in a

collaboration with Siemens-Nixdorf.

Julian Moore, Head of Algorithmic Insight

Before becoming an independent Business Analyst (currently at the

European Commission), Julian was a director of UK & US companies and

latterly, COO European Operations for an Australian VC-funded

simulation and optimisation company working in the field of aviation.

He has a BSc (Honours) in physics from Bristol University and has

produced articles and interviews with leaders in the philosophy and

practice of AI & machine learning (Prof. John Searle, UC Berkeley and Prof

Igor Aleksander, Imperial College London) for Philosophy Now magazine.

Following an introduction by the famous AI theorist Prof. Margaret

Boden, he was also an invited member of the Complexity Research Group

at the London School of economics.

Apart from AI & machine learning, Julian has an active research

programme concerning the existence of Closed Timelike Curves in

Einstein’s General Theory of Relativity.

Wouter Oosthuizen, STRATEGIC ADVISOR

Wouter has 23 years' experience in the financial industry. He completed his Masters in Computer Auditing at the University of Johannesburg. Thereafter he joined various leading Merchant and Investment Banks in South Africa. He performed extensive research on the application of Neural Networks and Genetic Algorithms in the development of quantitative trading systems.

In 2001 he established a South African company, Technovest(Pty)Ltd. As CEO of Technovest, he developed "The Grail" system evaluation methodology. This methodology applies a genetic and walk-forward optimizer to ensure that only robust systems are selected for inclusion in a portfolio. In June 2010, "The Grail" software was purchased by TradeStation Technologies Inc. and implemented into the TradeStation platform. Wouter relocated to Fort Lauderdale, USA to assist with the implementation of his software.

In January 2017 he returned to Cape Town, South Africa to focus on his latest cutting edge project. This product introduces a cloud based analysis engine to perform automated trading strategy design while incorporating multiple parallel bar interval back-testing for superior robustness.